How Smart Home Security Systems Can Save You Money on Insurance

How do smart home security systems help save money on insurance?

Smart home security systems can help homeowners save money on insurance premiums by up to 20%. Insurance companies offer discounts for homes with monitored security systems that alert authorities in an emergency. Installing a smart home security system may be offset by the savings on insurance premiums over time. Homeowners should check their insurance policies to see what types of smart home devices qualify for discounts before purchasing.

Smart Choice Security offers comprehensive security solutions for homes and businesses in the UK. Their advanced alarm systems, including CCTV cameras and access control, are designed to detect and deter intrusions. With professional installation, maintenance, and support, Smart Choice Security ensures that its customers have peace of mind knowing that their properties are protected.

In addition to security services, Smart Choice Security provides smart home services to integrate security systems with other home automation features. This integration ensures convenience and enhanced safety for homeowners. Homeowners can benefit from their industry-leading standards and certifications, including ISO 9001, ISO 45001, and Safe Contractor Approved, by choosing Smart Choice Security.

Investing in a smart home security system from Smart Choice Security offers peace of mind and can save homeowners money on insurance premiums. With discounts available for monitored security systems, homeowners can offset the cost of installation over time while enjoying enhanced safety and convenience.

What are the benefits of having a professionally installed smart home security system?

A professional, smart home security system is the way to go when protecting your home. While a DIY setup may seem more cost-effective, it may not provide the same coverage and protection as a professionally installed system. Smart home technology allows homeowners to remotely monitor their property through mobile apps or web portals, providing peace of mind and convenience.

One of the most significant benefits of a smart home security system is the potential for lower insurance premiums. Smart smoke detectors can detect fires early and potentially save lives while reducing property damage, leading to lower insurance claims costs in the long run. Water leak detectors can alert homeowners about potential water damage before it becomes severe enough to file an insurance claim, saving money on deductibles and preventing rate increases due to claims history.

At Smart Choice Security, we offer comprehensive security solutions for homes and businesses in the UK. Our advanced alarm systems, including CCTV cameras and access control, are designed to detect and deter intrusions. With professional installation, maintenance, and support, we ensure that our customers have peace of mind knowing that their properties are protected.

Investing in a smart home security system from Smart Choice Security offers peace of mind and can save homeowners money on insurance premiums. With discounts available for monitored security systems, homeowners can offset the cost of installation over time while enjoying enhanced safety and convenience. Check with your insurance provider to see what types of smart home devices qualify for discounts before purchasing.

In summary, a professionally installed smart home security system can provide better coverage than a DIY setup while offering potential savings on insurance premiums over time. With Smart Choice Security's comprehensive security solutions and industry-leading certifications, homeowners can trust that experts in the field protect their properties.

What type of smart devices qualify for discounts from insurers?

Regarding smart home security systems, many insurance providers offer discounts for monitored security systems that alert authorities in an emergency. However, some insurers require specific types of smart home security systems to qualify for discounts, so it's important to check with your provider before purchasing one.

Smart doorbells with video cameras are a popular choice for homeowners as they allow them to see who is at their front door even when they're not at home, providing an added layer of security. Some insurers may offer free or discounted installation services for certain smart home security systems.

It's important to note that most major brands have compatibility issues with each other, so it's crucial to choose compatible devices only. Smart smoke detectors can detect fires early and potentially save lives while reducing property damage, leading to lower insurance claims costs in the long run. Water leak detectors can alert homeowners about potential water damage before it becomes severe enough to file an insurance claim, saving money on deductibles and preventing rate increases due to claims history.

A professionally installed smart home security system may provide better coverage than a DIY setup but also comes at a higher cost. However, investing in a smart home security system from Smart Choice Security offers peace of mind and can save homeowners money on insurance premiums over time. With comprehensive security solutions and industry-leading certifications, homeowners can trust that experts in the field protect their properties.

How do multiple layers of protection affect discount rates from insurers?

Homeowners who install multiple layers of protection like alarms, cameras, motion sensors etc., will get more discounts from insurance providers. Insurance companies offer different discounts based on the type of system installed (monitored vs unmonitored). It is important to avoid buying cheap unbranded products because they might not meet the safety standards required by some insurance.

Smart doorbells with video cameras allow homeowners to see who is at their front door even when not at home, providing an added layer of security. Smart smoke detectors can detect fires early and potentially save lives while reducing property damage, leading to lower insurance claims costs in the long run. Water leak detectors can alert homeowners about potential water damage before it becomes severe enough to file an insurance claim, saving money on deductibles and preventing rate increases due to claims history.

Insurance companies may require homeowners to maintain their devices properly or replace faulty parts promptly. Failure to do so may increase premiums. Therefore, choosing a reliable and reputable company like Smart Choice Security for professional installation, maintenance, and support is essential.

In summary, installing multiple layers of protection with high-quality devices from a reputable company like Smart Choice Security can save homeowners money on insurance premiums over time. By investing in smart home security systems that meet safety standards required by insurers and maintaining them properly, homeowners can enjoy enhanced safety and convenience while reducing their insurance costs.

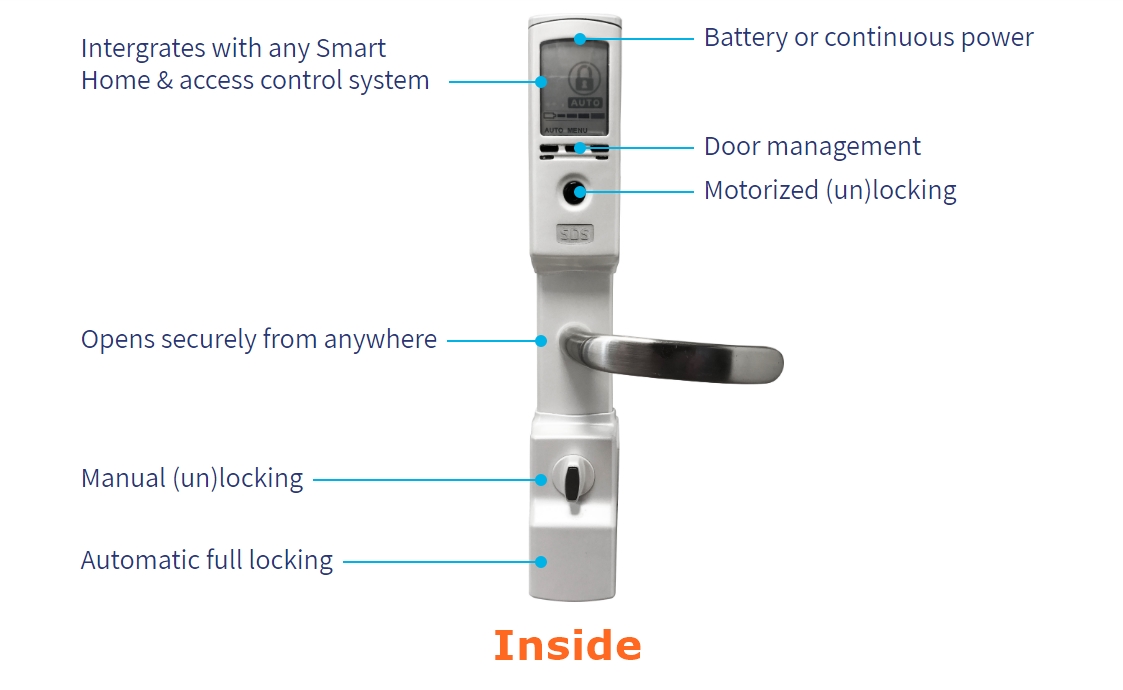

How do smart locks affect insurance premiums?

Smart locks are becoming increasingly popular among homeowners and for good reason. Some insurers offer a discount on the policy if you install smart locks, which can be controlled remotely via a mobile app or web portal. This added layer of protection provides convenience and enhanced safety for homeowners.

Insurers prefer smart home security systems with 24/7 professional monitoring services as it provides better protection and reduces false alarms. Most major brands have apps integrating multiple devices into one platform allowing easy control over the entire house through a single interface.

Homeowners should regularly update software/firmware versions for maximum efficiency/security. It is important to avoid buying cheap unbranded products because they might not meet the safety standards required by some insurance. Insurance companies may offer different discounts based on the type of system installed (monitored vs unmonitored).

It is vital to maintain your device properly and replace faulty parts promptly. Failure to do so may increase premiums. Therefore, choosing a reliable and reputable company like Smart Choice Security for professional installation, maintenance, and support is essential.

Investing in a smart home security system from Smart Choice Security offers peace of mind and can save homeowners money on insurance premiums over time. With comprehensive security solutions and industry-leading certifications, homeowners can trust that experts in the field protect their properties.

In summary, smart locks provide a layer of protection for homeowners and may lead to discounts on insurance policies. By choosing a reputable company like Smart Choice Security and maintaining your devices properly, you can enjoy enhanced safety and convenience while reducing your insurance costs.

What other types of coverage should homeowners consider besides a smart home security system?

A smart home security system is an excellent start when protecting your home. However, homeowners should consider additional coverage to protect themselves against potential losses. For example, flood or earthquake insurance may be necessary depending on the location and risk factors. Increasing liability limits could help cover legal expenses resulting from an accident caused by someone else while on your property.

A comprehensive policy will cover theft, fire, vandalism, and natural disasters, but it's important to review your policy regularly to ensure adequate coverage. A good credit score can lead to lower insurance rates, so it's worth taking steps to improve your credit score if necessary.

Smart Choice Security offers comprehensive security solutions for homes and businesses in the UK. Our advanced alarm systems, including CCTV cameras and access control, are designed to detect and deter intrusions. With professional installation, maintenance, and support, we ensure that our customers have peace of mind knowing that their properties are protected.

In summary, a smart home security system is an excellent start to protecting your home, but additional coverage may be necessary depending on your location and risk factors. Homeowners should also consider increasing liability limits and maintaining a good credit score to save money on insurance premiums. With Smart Choice Security's comprehensive security solutions and industry-leading certifications, homeowners can trust that experts in the field protect their properties.

How do self-monitored vs professionally monitored systems affect insurance premiums?

Regarding smart home security systems and insurance premiums, homeowners should consider the type of monitoring service they choose. A professionally monitored system will alert authorities immediately during emergencies, whereas self-monitored ones rely solely on the homeowner's response time. Most major brands have compatibility issues with each other, so it's crucial to choose compatible devices only.

Insurance companies may increase your premium if you don't maintain your device properly or fail to replace faulty parts promptly. Therefore, it's important to read reviews from other customers before purchasing any particular brand/model/device. Homeowners should also consider adding additional coverage, such as flood or earthquake insurance, depending on their location and risk factors, to protect themselves against potential losses.

Increasing liability limits could help cover legal expenses resulting from an accident caused by someone else while on your property. A comprehensive policy will cover theft, fire, vandalism, and natural disasters. Having a good credit score can lead to lower insurance rates.

Smart Choice Security offers comprehensive security solutions for homes and businesses in the UK. Our advanced alarm systems, including CCTV cameras and access control, are designed to detect and deter intrusions. With professional installation, maintenance, and support, we ensure that our customers have peace of mind knowing that their properties are protected.

Choosing a professionally monitored smart home security system is essential for homeowners who want to save on insurance premiums while ensuring maximum property protection. Smart choice security offers industry-leading certifications and comprehensive security solutions to meet the needs of every homeowner or business owner in the UK. by investing in a reliable and reputable company like smart choice security; homeowners can enjoy enhanced safety and convenience while reducing their insurance costs.

Can smart home technology save money beyond just lowering insurance premiums?

Smart home technology has revolutionised the way we live, and it can save homeowners money beyond just lowering insurance premiums. For example, smart thermostats allow homeowners to remote control heating/cooling settings, which could help reduce energy bills if used effectively. Smart lighting systems that mimic occupancy patterns can deter burglars and reduce the likelihood of break-ins while saving energy costs in the long run.

Installing a smart water shutoff valve can prevent costly damage caused by burst pipes or leaks while potentially lowering insurance premiums. Insurance companies recognise that proactive measures to prevent water damage are more effective than reactive measures to repair it.

Some insurers are partnering with smart device manufacturers offering exclusive deals/discounts when you purchase both policies. This could lead to significant savings for homeowners seeking comprehensive security solutions and insurance coverage.

Smart Choice Security offers comprehensive security solutions for homes and businesses in the UK. Our advanced alarm systems, including CCTV cameras and access control, are designed to detect and deter intrusions. With professional installation, maintenance, and support, we ensure that our customers have peace of mind knowing that their properties are protected.

Smart home technology can save homeowners money beyond just lowering insurance premiums. From reducing energy bills to preventing costly water damage, investing in comprehensive security solutions like smart choice security can provide long-term benefits for homeowners. By proactively protecting their properties and integrating security systems with other home automation features, homeowners can enjoy enhanced safety and convenience while saving time.

How do I choose the right smart home security system?

Choosing the right smart home security system can be daunting, but it's essential to ensure that your property is adequately protected. Homeowners should research different providers and compare prices and features before choosing a system that meets their needs and budget. It's important to note that mostly all major brands have compatibility issues with each other, so make sure you choose compatible devices only.

Avoid buying cheap unbranded products because they might not meet the safety standards required by some insurance. It's crucial to read reviews from other customers before purchasing any particular brand/model/device to ensure you're making an informed decision.

Smart Choice Security offers comprehensive security solutions for homes and businesses in the UK. Our advanced alarm systems, including CCTV cameras and access control, are designed to detect and deter intrusions. With professional installation, maintenance, and support, we ensure that our customers have peace of mind knowing that their properties are protected.

When choosing a smart home security system, homeowners should consider their specific needs. For example, if they live in an area prone to flooding or earthquakes, they should consider adding additional coverage like flood or earthquake insurance.

Smart thermostats allow homeowners to remote control heating/cooling settings which could help reduce energy bills if used effectively. Smart lighting systems that mimic occupancy patterns can deter burglars and reduce the likelihood of break-ins while saving energy costs in the long run. Installing a smart water shutoff valve can prevent costly damage caused by burst pipes or leaks while potentially lowering insurance premiums.

In summary, choosing the right smart home security system requires careful consideration of your specific needs and budget. By partnering with a reputable company like Smart Choice Security, homeowners can enjoy enhanced safety and convenience while reducing their insurance costs. With our industry-leading certifications and comprehensive security solutions, we provide peace of mind knowing that experts in the field protect your property.

What documentation do I need to provide to my insurer for proof of installation?

When choosing the right smart home security system for your needs, there are several factors to consider. Firstly, homeowners should research different providers and compare prices and features before choosing a system that meets their needs and budget. It's important to note that mostly all major brands have compatibility issues with each other, so make sure you choose compatible devices only.

Another crucial consideration is the documentation insurance companies require as proof of installation and activation before offering discounts on premiums. Therefore, homeowners should keep all documentation handy and meet their insurer's requirements.

Smart Choice Security offers comprehensive security solutions for homes and businesses in the UK. Their advanced alarm systems, including CCTV cameras and access control, are designed to detect and deter intrusions. With professional installation, maintenance, and support, Smart Choice Security ensures that customers have peace of mind knowing that their properties are protected.

Insurance companies offer discounts for homes with monitored security systems that alert authorities in an emergency. The savings on insurance premiums over time may offset the cost of a smart home security system. However, some insurers require specific types of smart home security systems to qualify for discounts. Therefore, it's important to check with your provider before purchasing one.

Choosing the right smart home security system requires careful consideration of your specific needs and budget. homeowners should research different providers and compare prices and features before deciding. additionally, they should keep all documentation handy and ensure they meet their insurer's requirements for proof of installation and activation. with smart choice security's comprehensive security solutions and industry-leading certifications, homeowners can trust that experts in the field protect their properties.

Are there any potential drawbacks or risks associated with using a smart home security system?

Smart home security systems have become increasingly popular in recent years and for a good reason. They offer convenience, enhanced safety, and potential savings on insurance premiums. However, like any technology, there are potential drawbacks and risks associated with using a smart home security system.

One of the most significant concerns is the risk of hacking. While most major brands have apps that integrate multiple devices into one platform, allowing easy control over the entire house through a single interface, this also means that hackers could potentially gain access to all devices connected to the system. Therefore, it's crucial to choose a reputable provider with robust security measures in place.

Another potential drawback is the cost of installation and maintenance. While some insurance companies offer discounts for homes with monitored security systems that alert authorities in an emergency, the cost of a smart home security system may still be high. However, these costs can be offset by the savings on insurance premiums over time.

It's also important to note that some insurers require specific types of smart home security systems to qualify for discounts, so it's essential to check with your provider before purchasing one.

In summary, while there are potential risks and drawbacks associated with using a smart home security system, they can provide significant benefits if used correctly. By partnering with a reputable company like Smart Choice Security, homeowners can enjoy enhanced safety and convenience while reducing their insurance costs. With our industry-leading certifications and comprehensive security solutions, we provide peace of mind knowing that experts in the field protect your property.

Final Thoughts

Smart Choice Security is a leading UK-based company that offers comprehensive security solutions for homes and businesses. Our advanced alarm systems, including CCTV cameras and access control, are designed to detect and deter intrusions, providing peace of mind to our customers. We pride ourselves on our professional installation, maintenance, and support services, ensuring that our customers have the best possible experience with us.

One of the significant benefits of partnering with Smart Choice Security is the potential savings on insurance premiums over time. Insurance companies offer discounts for homes with monitored security systems that alert authorities in an emergency.

However, checking with your provider to see what types of smart home devices qualify for discounts before making any purchases is essential. Homeowners should research different providers and compare prices and features before choosing a system that meets their needs and budget. Depending on location and risk factors, it's also important to consider additional coverage, such as flood or earthquake insurance.

We offer smart home services to integrate security systems with other home automation features at Smart Choice Security, ensuring convenience and enhanced safety. With our industry-leading certifications and comprehensive security solutions, homeowners can trust that experts in the field protect their properties.

Smart Choice Security provides peace of mind to homeowners and businesses by offering advanced alarm systems, professional installation, maintenance, and support services. Our potential savings on insurance premiums over time make us an attractive choice for those looking for comprehensive security solutions. By researching different providers and checking with your insurance provider about qualifying devices, homeowners can ensure they have the best protection for their property.